How Much Does Costco Make? 93 Statistics

Key Costco Statistics

- Costco's total annual revenue in 2021 was $195.929 billion.

- The daily revenue for one Costco store is around $530,000.

- Costco's total net income was $5.007 billion in 2021.

- Costco has 804 global stores, with over 500 of those being located in the US.

- Costco's net worth in January of 2022 is $214.1 billion.

- Costco has more than 120 stores in California, with the next highest number being located in Texas.

- Costco's most commonly frequented location is located on Oahu in Hawaii, which has four stores in total.

- Costco has more than 280,000 employees worldwide.

- Over 105 million people have Costco membership cards throughout the globe.

- Costco's market cap is over $210 billion in 2022, making Costco the 51st most valuable global company.

- At the end of 2021, Costco's long term debt had declined to $6.7 billion as Costco paid back some of their pandemic investments.

- In both 2020 and 2021, Costco's shares outstanding were about 444 million.

Overview Of Costco

Costco Revenue Statistics

Costco Annual Revenue

- Costco's total annual revenue in 2021 was $195.929 billion.

- Costco's revenue from November 2020 to November 2021 was $203 billion dollars.

- Costco's annual revenue increased about 17.5% in 2021 compared to 2020.

- Costco's annual revenue in 2020 increased about 9.2% compared to 2019.

Costco's annual revenue has grown significantly from year to year. During the COVID-19 pandemic, the wholesaler's growth rate almost doubled compared to previous years.

The revenue is spread across more than 500 locations in the US. Revenue refers to the total amount of money accrued before subtracting expenses to calculate the net income.

Costco Quarterly Revenue

The quarterly revenue reported throughout 2021 tended to eclipse that which was reported in 2020.

- Costco's quarterly revenue report for November of 2021 showed $50.36 billion in revenue.

- Compared to November of 2020, Costco's November 2021 revenue increased about 16.5%.

- In 2021, Costco's quarterly growth reached its highest point since the 1990's.

Costco Daily Revenue

- The daily revenue for one Costco store is about $530,000, depending on the store's location and foot traffic.

- Costco's total combined locations make about $447 million per day in revenue.

- In total, all of Costco's global stores bring in about $5,175 in revenue for every second that passes.

Costco Online Ecommerce Revenue

- Costco brought in about $4.5 billion in Ecommerce revenue in 2019.

- Costco's online revenue rose to more than $6.8 billion in 2020, when many shoppers switched to online shopping due to the effects of the COVID-19 pandemic.

- Costco's online store brought in $7.5 billion in 2021. While this number was a large increase from 2020, it wasn't as dramatic as the gap between 2019 and 2020.

- Sales in Costco's online store are expected to generate about $8.1 billion in revenue in 2022.

Ecommerce revenue for Costco rose sharply during the COVID-19 pandemic and has grown significantly since 2019. In 2022, the store is projected to earn nearly double its 2019 revenue in online sales.

Costco Revenue By Region

Number of Costco Customers

- The number of Costco card holders reached more than 105 million globally in 2020.

- In 2019, Costco had 98.5 million card holders.

- Costco's cardholders increased about 70% between 2019 and 2020, which may be attributed to the COVID-19 pandemic.

- Most Costco memberships are household and Gold Star cards, accounting for 47.4 and 46.8 million respectively in 2020.

- There are just 11.3 million Costco business cardholders, which includes all of the affiliates of the business.

The number of Costco customers is calculated based on the number of people who hold an active card membership. Membership is required in order to shop at the store.

Though not everyone who holds a membership will actively shop at Costco every year, it can be safely assumed that the majority do at least once.

There are a few different types of card. Household cards are issued to a single person.

Gold Star cards include a primary member, along with a second adult who can use the card to shop. Business Member cards allow the primary cardholder to designate more than one other person to shop at Costco.

Costco Gross Profit

- In 2020, Costco's overall gross profit margin was 11.2%.

- The overall gross margin for the years 2015 through 2019 has always been between 11 and 11.4%.

- The gross profit for the final reported quarter of 2021 was $25.9 billion.

- In 2021, the overall gross profit increased while the gross margin decreased slightly due to the company's operating costs.

The gross margin and gross profit of a company tell you how much revenue they retain after they subtract the costs their products.

High gross margins and gross profits mean that a company has more profits to distribute to shareholders and use for their expansion.

Gross profits for the company have remained relatively stable in terms of the margin.

Costco Stock Price History

- The price of the company's stock has fallen slightly over the first few weeks of January 2022, going from around $570 to $480.

- The company reached a record-breaking closing price high at the end of December in 2021, when the stock was trading at $567.

- Over the past year, the highest number that the price has reached in a week is a little over $571.

- The lowest stock price recorded over the past year was just $307, nearly 37% below the current trading value.

- There are nearly 2,900,000 shares in the company available for trade and holding.

Costco's stock prices have been tracked on a daily basis since 1986. There is a wealth of data available regarding the company's value.

The stock closing price refers to the price at the end of the day, while the week high price refers to the highest number the price reaches in a week.

Costco Market Cap

As of January of 2022, Costco is the 51st most valuable corporation in the entire world based on market cap.

- The market cap of Costco on January 20, 2022 was $213.56 billion.

- The company reached an all-time high of $244.05 billion by the end of 2021.

- Between 2020 and 2021, the market cap of the company increased more than 46%, which helped to boost the portfolio of Costco investors.

- In 2002, the market cap was just $12.8 billion, which means that the corporation is now about 20 times as valuable as it was just 20 years ago.

The market cap of a company is the value of its combined stock shares. Since Costco has so many shares that trade for such a high price, it is among the most valuable companies in the world.

The market cap of the company has also risen during most years since 2001. The only years in which the value incurred a loss were 2002, 2008, and 2016.

As of January of 2022, the market cap has incurred some losses. There is still time for the company to rebound from the loss of its stock price.

The downward trend isn't necessarily caused by specific economic factors. Instead, it may be related to how the stock's all-time high was reached at the end of December of 2021.

Costco Operating Income

- In the final quarter of 2021, the operating income for Costco was around $1.7 billion. This represented an increase of more than 18% compared to the final quarter of 2020.

- The total annual operating income for 2021 was almost $7 billion, which represented more than a 20% increase compared to 2020.

- The 2021 operating income increased more than 23% from 2020. This might be related to the COVID-19 pandemic, because the income difference between 2018 and 2019 was only 5.7%.

The operating income of a company shows the total profit made after the normal recurring expenses and costs are subtracted.

This differs from the revenue because the revenue has not yet subtracted these costs.

Costco EBITDA

- Costco's EBITDA for all four quarters of 2021 was $8.48 billion, which reflected an increase of nearly 20% compared to the previous year.

- In 2020, the EBITDA increased 13.66%, compared to just 5.27% in 2019.

The EBITDA of a company is an important measure of their earnings prior to taxes, interest, and other financial factors.

This is slightly different from net income because it does not include the prices of capital investment.

Costco Net Income

- Costco's total net income was $5.007 billion in 2021, which represented an increase of more than 25% compared to 2020.

- 2020's net income increased just 9.4% compared to the previous year, while 2019's net income had an increase of nearly 17% compared to 2018.

Costco's net income takes into account the company's operating expenses and the cost of investments.

What's left over is the overall profit, much of which is paid to shareholders.

In Costco's case, the net income is significantly less than the EBITDA because of the investments that it takes into account.

The total net income has increased substantially for the past several years.

The increase in 2020 was much less than that of 2019, indicating a potential slowing of growth due to the COVID-19 pandemic. But the 2021 income was much higher.

Costco EPS

- Costco's total EPS for all of 2021 was $11.27, which is an increase of almost 25% compared to 2020.

- Between 2018 and 2019, the EPS increased by 16.5%. The increase was only 9.2% the following year, possibly due to effects from the COVID-19 pandemic.

The earnings per share refer to the amount of income that each Costco shareholder generates with their holdings.

Profits are divided among the shareholders at the end of every quarter.

Since 2006, the earnings per share have gradually increase on a year by year basis.

Some of the increases are more dramatic than others. For example, growth was slow from 2006 to 2008, but the EPS increased dramatically between 2020 and 2021.

Because the company is so large and has so many shares, the EPS is just a fraction of the value of the share price itself.

More income comes from the cost of the shares than the company's overall earnings.

Costco Shares Outstanding

- In both 2020 and 2021, Costco's shares outstanding were about 444 million. The exact number increased by 0.1% between 2020 and 2021, but the increase wasn't enough to move the calculation.

- There have been at least 441 million shares every year since 2013, with the numbers fluctuating just slightly. This shows a high level of stability in the face of different market forces.

The shares outstanding are the company stocks that are held by all types of shareholders.

There are often fluctuations in the shares outstanding for a company. These shares make a difference in calculating the total EPS and other share-related profit statistics.

While the number of shares outstanding for Costco has increased slightly each year since 2017, the overall volume has remained relatively stable since 2008.

In 2008, the number of shares was around 444 million, which is the same number that ended the 2021 fiscal year.

The highest number of shares outstanding since 2005 was in 2005, when there were 492 million shares. The lower number of shares today allows for greater earnings per share for investors.

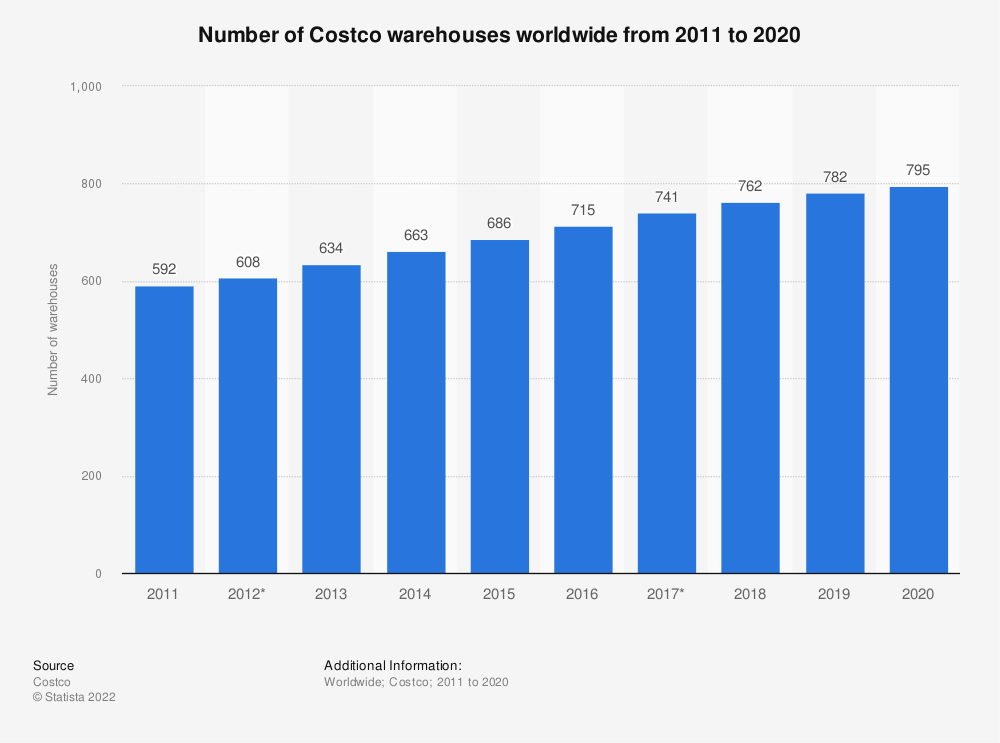

Number of Costco Stores

How many Costco stores are there in the world?

Costco is a global corporation that operates a total of 804 stores all over the world. In 2011, that number was just 592.

This indicates that the company has been growing stably over the past decade, wisely investing in new stores while balancing their profit potential.

The bulk of the stores are located in the US. But there are also locations in Canada, Mexico, the UK, Japan, Taiwan, South Korea, Australia, and Spain. France has just two locations, while both Iceland and mainland China have a single store.

New locations are often opened globally. Currently, there are plans for the company to open new stores in Sweden and New Zealand during 2022 to increase their global reach.

How many Costco stores are there in the US?

Of more than 800 locations around the globe, 558 of Costco's stores are located in the US. This includes locations in Puerto Rico and Washington D.C.

Far more states in the US have Costcos than don't. But the company is not present in all 50 states. You won't find a Costco in Rhode Island, Maine, West Virginia, or Wyoming. But all 46 other states in the US have at least one location.

Washington D.C. has just one location. There are five other states which only have a single Costco. These include New Hampshire, Vermont, Delaware, Mississippi, and South Dakota.

The state with the most locations by far is California. Part of this may be attributed to California's large population and sprawling geography.

But it has more than 130 locations. The next highest number of locations is in Texas, which has a similarly large population and geographic base. Texas has just 33 stores.

The next three most populous Costco states are Washington with 32 stores, Florida with 28 stores, and Illinois with 22 stores.

Number of Costco Employees

- There are 189,000 Costco employees located in the US, counting both part time and full time labor.

- On a global scale that includes the US, there are 288,000 employees counting both part time and full time labor.

- In 2020, there were about 156,000 full time and 117,000 part time employees.

Costco hires employees to manage each aspect of store operation on both a full time and part time basis.

The number of employees has grown each year as the company expands its locations and increases its profit potential.

Costco employs more full time workers than part time ones, a statistic that has remained true for the entirety of its operation.

Full time workers have more availability and expertise than part time ones, but also require more investment in company benefits.

Costco Assets & Liabilities Statistics

Costco Total Assets

- The company had over $59 billion in total assets during 2021, up 6.7% in comparison to 2020.

- During 2020, the total assets increased more than 22% in comparison to 2019, possibly related to the COVID-19 pandemic. The increase from 2018 to 2019 was a little over 11%.

The total assets refer to the amount of assets on the company balance sheet.

Costco's total assets have increased every year since 2005, excluding a very minor drop between 2014 and 2015. In 2021, the company has more than 3.5 times as many total assets as it did in 2005.

The total assets increased sharply between 2019 and 2020. The increase in 2021 was not as dramatic, but was still substantial.

Costco Cash On Hand

- Costco had $12.18 billion cash on hand at the end of 2021, down about 8.5% from a peak of $13.31 billion in 2020.

- Costco's cash on hand increased 40.88% in 2020. In 2019, prior to the COVID-19 pandemic, the cash on hand increased by over 30%. This indicates that the company was making an effort to have more liquidity available even before the economic uncertainty.

A company's cash on hand is the amount of liquid cash they have on hand to save or invest.

In 2021, Costco's cash on hand declined slightly from 2020. But the decline wasn't sharp enough to offset the massive increases from the previous years.

Since 2017, the company's cash on hand has more than doubled.

Costco Long Term Debt

- In 2020, Costco's long term debt increased from $5.1 billion to $7.5 billion.

- At the end of 2021, Costco's long term debt had declined to $6.7 billion as Costco paid back some of their pandemic investments.

Costco does have a fair amount of long term debt. However, the company's debt is not alarmingly larger than its profits and revenue. It is within acceptable ranges for successful operation.

So far, the company has been paying back some of the debt it accumulated in 2020. It acquired the largest amount of debt in 2013, when it took on about three times the debt amount of the previous year.

Costco Total Liabilities

- Costco's total liabilities at the end of 2021 were a little over $41 billion, which was an increase of about 11.8% from the previous year.

- Liabilities rose sharply in 2020, increasing by about 23.6% compared to 2019.

- In 2005, the total number of liabilities was just $7.8 billion, significantly less than the number today.

Liabilities are a necessary part of growth and operation for a business, especially a business of Costco's size.

Costco has about six times as many liabilities at the end of 2021 as it did in 2005.

The number of liabilities has almost doubled between 2016 and 2021, going through sharp increases over the past few years.

Costco Shareholder Equity

Shareholder equity is calculated on a quarterly basis. It refers to the amount that shareholders would still own if the company was forced to give up its assets due to liabilities.

The shareholder equity at the end of November of 2021 was $19 billion. That is a substantial increase from the $15.3 billion of 2020.

The number decreased somewhat from 2019 to 2020 due to the many liabilities taken on, but it has increased since then to about $2.8 billion more than the 2019 value.

Costco Margins Statistics

Costco Profit Margins

Costco's profit margins for the quarter ending in November of 2021 were 2.54%.

The company's profit margins are the percentage of revenue that is retained as income after expenses and investments.

Costco's margins are relatively low, but this allows them to sell items at a lower cost, which is how they retain customers.

Costco Gross Margins

- In 2020, the total gross margin for the company was around 11.2%.

- The gross margin for the quarter ending in November of 2021 was 12.73%, showing a slight increase from the previous year.

This margin is relatively low compared to other retailers, largely due to Costco's low pricing structure.

Costco Operating Margins

The operating margins for the company are calculated by dividing the operating income by the revenue.

- For the quarter ending in November of 2021, Costco's operating margins were about 3.36%.

- As of January of 2022, the operating margin is the highest it has been in the past decade, coming in at 3.43%.

- The lowest that the operating margins have been in the past 10 years was 2.78%.

Again, these margins are low. But their stability indicates that Costco is operating according to a stable plan.

Costco EBITDA Margins

- The EBITDA margins for Costco are about 4.6% for the twelve months between January 2021 and January 2022.

- This is an increase from the EBITDA average between 2017 and 2021, which was 4.3%.

- The margin's peak was in November of 2021 at the current 4.6%.

These numbers show growth and stability with regards to the company's earnings.

Costco Pre-Tax Profit Margins

- The pre-tax profit margins for Costco for the quarter ending in November of 2021 were 3.43%, up from 3.31% during the same quarter of 2020.

- Profit margins fell at the beginning of 2021 but then steadily increased.

- The 3.43% pre-tax profit margin is the peak margin that the company has reported in its data.

Costco Net Margins

- Costco's net margins for the final quarter of 2021 were 2.54%, down slightly from 2.56% in the previous quarter.

- The net margins haven't been lower than 2% since partway through 2017.

Costco Price Ratios

Costco PE Ratio

- Costco's PE ratio as of January 20, 2022 is 41.41.

- The peak PE ratio coincided with the company's peak stock prices at the end of 2020. It was a ratio of 46.38.

Costco's price-to-earnings ratio shows how the company's share price is valued in comparison to the earnings per share. The PE ratio peaked in the final quarter of 2021. Since the stock price has fallen slightly since then, the PE ratio has as well.

Costco P/S Ratio

- The P/S ratio in January of 2022 is about 1.05, thanks to the $481.61 stock price and the $456.98 revenue per share.

- The lowest P/S ratio for the past ten years was 0.36, while the highest was 1.24.

The P/S ratio is necessary to compare the market price of Costco to the revenue per share.

Costco Price/Book Ratio

- Costco's price/book ratio as of January 20, 2022 is about 11.27.

- The price/book ratio for the final quarter of 2021 was about 12.59, the company's highest measurement to date.

A thriving company will typically have a price-to-book ratio above 1.0, while companies that struggle may have a ratio much lower than this. Costco's ratio indicates that it is thriving as a company.

Costco Price-FCF Ratio

The price to free cash flow ratio is calculated based on a company's share price and its free cash flow for each share.

- The price-FCF ratio is currently one of the lowest recordings in the past decade, at 36.76.

- The lowest price-FCF ratio that Costco recorded in the past decade was 15.91, while the highest was 116.02.

Costco Net Worth

Costco is one of the largest corporations in the world by market cap. As of 2021, it is the tenth-largest US corporation based on its revenue.

- Costco's net worth in January of 2022 is $214.1 billion.

- The highest recorded net worth was more than $240 billion at the end of 2021.

Costco Other Ratios

Costco Current Ratio

The current ratio compares the company's assets and liabilities. A good ratio means that a company has fewer liabilities than assets.

- Costco's current ratio for the final quarter of 2021 was 1.02.

- The company has maintained a ratio of about 1.0 for several consecutive quarters.

Costco Quick Ratio

- The quick ratio for Costco at the end of 2021 was 0.51.

- This low ratio shows that the company isn't capable of paying the current liabilities back in full if necessary.

Costco Debt/Equity Ratio

- At the end of 2021, the debt to equity ratio for the company was 2.38.

- The ratio remained relatively steady throughout 2020 and 2021, fluctuating between 1.8 and 2.9.

Costco ROE

- The return on equity at the end of 2021 was 29.44%.

- The company's return on equity peaked in the third quarter of 2021 at 30.12%.

Costco ROA

- Costco's return on assets for the final quarter of 2021 was 8.77%.

- This was an increase from the same period of the previous fiscal year, which had a return on assets percentage of just 8%.

Costco ROI

- Costco's ROI in the final quarter of 2021 was 28.29%.

- The ROI for the same quarter of 2020 was 24.19%, indicating that there was an increase in 2021.

A company's return on investment indicates how much of their money was made back as a result of their investments. Ideally, they should make back more than they invested.

Costco Return on Tangible Equity

- The company's return on tangible equity for the final quarter of 2021 was 29.44%.

- The return on tangible equity percentage peaked in the third quarter of 2021, when it reached a rate of 30.12%.

Frequently Asked Questions

What is the #1 selling item at Costco?

Toilet paper is the top selling item at Costco. People like being able to buy their toilet paper in bulk from wholesalers. In fact, over a billion total rolls are sold by the chain on an annual basis.

In addition to the bulk purchase appeal, the Kirkland brand of toilet paper at Costco is both affordable and high quality.

How much does one Costco make a day?

When you divide the number of locations by the average daily amount of income for the corporation, the average Costco store makes somewhere between $526,000 and $570,000 every day.

Costco calculates its profits based on the daily earnings of all of its stores. Different stores might have different earnings depending on their location and competition.

What is Costco best known for?

Costco is a wholesaler that allows people to buy household goods and other items for affordable prices. You need a membership to shop in the store, but the cost savings tend to make up for the price.

Perhaps their best-known deal is the hot dog and soda combination. Since 1985, the combo has remained at a fixed price of $1.50. Since it hasn't been adjusted for inflation, this is one of the cheapest food-and-drink combinations on the market.

Where is Costco most popular?

The most popular location for Costco is on Oahu Island, located in Hawaii. The chain has four stores on the island, and around 25% of the 950,000 residents have a membership.

That means that hundreds of thousands of people are going to Costco on a regular basis.

If you're talking about the area with the most locations, California has significantly more Costcos than any other state.

They have over 120 stores dispersed throughout the state. The US in general is home to well over half of Costco's global locations.

How does Costco make so much money?

Costco has 571 total locations throughout the United States.

Some of their revenue comes from the memberships that people use to shop. But most of the income is related to product sales.

About 92% of the company's 2020 revenue was related to product sales in store.

Though you might expect the memberships to be a substantial portion of the income, they're barely more than 2% of the total.

The company also makes efforts to expand wisely into new market sectors.

For example, in 2022, there are plans to open new global locations in New Zealand and Sweden.

During the COVID-19 pandemic, Costco saw a substantial increase in online shopping. This was the case for most major retailers as well.

While Costco appears to have based most of their business plan around continued in-store shopping, the impacts of their online store cannot be understated.

How much does Costco lose to theft each year?

Costco has one of the lowest shrinkage rates of any wholesaler or retailer in the US. They lose about 0.12% of the amount of their total sales to shoplifting.

There are several reasons for this.

One of the reasons is that Costco requires a membership to enter and shop. Since the memberships cost about $60 per year, the customers tend to be more affluent.

They have already showed that they're willing to make purchases. In addition, memberships make customers feel more loyal to the store in general.

Another factor is the layout of the store. There is typically only one entrance and exit. Because an employee checks people's cards at the door, it is more difficult to walk out with store merchandise.

Loss prevention is an important aspect of Costco's business model. Because they operate with such thin margins, a high amount of theft could be detrimental to their operations.

Which state has the most Costcos?

There are more Costcos in California than any other state by far. In California, there are 131 Costco warehouses in operation. The state with the next highest number of Costcos, Texas, only has 33 operating locations.

Five states don't have any Costco locations at all. There are also several that only have one store, such as New Hampshire and Vermont.

Who owns Costco?

Costco is a publicly traded company, meaning that anybody can buy shares of the wholesaler on the stock market. The founders are James Sinegal, Sol Price, Robert Price, and Jeffrey Brotman.

How much do Costco employees make?

The salary of a Costco employee depends on their location. In many parts of the US, cashiers start at around $15 an hour or more. Supervisors and managers report making around $30 per hour.

Statistics show that the average hourly pay for a cashier is about $13.88. Depending on the state, this can be far above minimum wage. Costco also employs more full time employees than part time ones.

The more a company pays their employees, the better their employee retention will be. Costco ranks highly for its workplace environment on several job sites.

Conclusion

Costco is one of the most popular wholesalers in the United States. We hope that these statistics have helped to teach you about what the company has to offer.

How To Clean Tile Floors

Now you can order cleaning services

in just 5 minutes